Fannie, Freddie, and the Crisis

We all know the familiar story of how the financial crisis that precipitated the Great Recession supposedly came to be. Mortgage lenders issued a large number of exotic, subprime, adjustable-rate mortgages that were packaged into securities eventually purchased by the enormous government-sponsored enterprises Fannie Mae and Freddie Mac. Borrowers who availed themselves of such mortgages, and especially of those that offered so-called "teaser" rates — which allowed consumers to make very small payments at first and then required them to pay far more as the rates reset upward after a period of two or three years — defaulted in large numbers beginning in 2007. That wave of defaults drove a mortgage crisis that became a banking crisis and eventually an economic crisis and severe recession.

Familiar as it has become, this story was not how the housing crisis was understood as it was happening. In fact, Fannie and Freddie were initially viewed by policymakers as the potential saviors of a housing-finance market that was quickly unraveling. On March 19, 2008, Fannie and Freddie's regulator, the Office of Federal Housing Enterprise Oversight, moved to ease capital regulations on the GSEs so they could actually grow faster and replace the private lenders that had withdrawn from the mortgage market. The bargain was that the firms would lend now and then boost their capital later. The GSEs instead hit a wall a few months later when equity investors recognized the scale of embedded losses far exceeded their capital reserves.

The expectation that the two GSEs could save the market without a bailout from taxpayers now seems preposterous. Fannie and Freddie were the most highly leveraged financial institutions on the planet and were required by their charters to invest in nothing but American residential mortgages. To expect them to bail out the American mortgage market would be like turning to General Motors to rescue auto-parts suppliers in the midst of a huge slump in car sales. Fannie and Freddie's lack of diversification and comically inadequate capital base always guaranteed they would fail in any significant housing downturn.

Policymakers were blinded to the GSEs' obvious potential for insolvency because they mistakenly assumed the crisis was contained to a specific category of subprime mortgages. They were wrong. But for that very reason, the now-familiar story of how Fannie and Freddie helped to cause the housing crisis is also wrong.

The spike in mortgage default volumes in 2007 and 2008 was not a result of resets in mortgage payments, but was instead a function of the collapse in house values, which serve as the collateral for mortgage loans. Fannie and Freddie's losses did not come from subprime loans made to low-income borrowers with checkered credit histories, but from loans made in overheated housing markets to borrowers with better-than-average credit scores.

Fannie and Freddie were surely woefully under-capitalized and under-regulated, and they knowingly transferred risk to taxpayers that should have been borne by the companies' own creditors and shareholders. But the prevailing narrative that casts them as the arch-villains of the broader crisis ignores basic facts regarding the ultimate source of Fannie and Freddie's losses — and indeed, basic facts about how the housing market works. Recovering those basic facts will lead us to a better understanding of what went wrong and why.

THE ORIGINS OF THE MORTGAGE CRISIS

The debate over the origin of the mortgage crisis comes down to a simple question: What makes a mortgage "high risk"? To many observers, a risky mortgage is one that deviates in any way from the traditional, 30-year fixed-rate prime mortgage loan. In this view, the spike in mortgage default volumes and the failures of Fannie and Freddie are easily explained by the sizeable growth of "non-traditional" mortgages between 2000 and 2007.

The problem with this interpretation is that non-traditional mortgages often have very little in common with one another. A subprime loan made to a borrower with no equity and a long history of unpaid bills is quite different from an interest-only mortgage made to a high-income borrower with a solid credit score and larger-than-average down payment. The mere fact that neither is a 30-year fixed-rate loan does not mean they resemble each other. If such dissimilar mortgages were to default at the same frequency, those defaults would have to be explained by some common factor that actually unites them.

Because the first wave of defaults in 2007 involved subprime mortgages with adjustable interest rates, many economists and policymakers blamed the crisis on these mortgages' non-traditional payment features. The initial policy response to the crisis therefore focused on facilitating mortgage-contract renegotiations for borrowers experiencing payment shocks as their low initial payment rates expired. Analysts began to pay special attention to the schedule of mortgage payment resets, assuming that future waves of defaults would be tied to the timing of subprime-mortgage resets.

This initial misdiagnosis continues to confuse the public regarding the cause of the mortgage crisis in two damaging ways. First, the exotic nature of these mortgages focused the public's attention on the mortgage products' designs, leading observers to conclude that any variation in default rates could be explained by unusual payment types, the waiving of documentation requirements (like proof of income or assets), and peculiar amortization schedules. But as we shall see, in most cases, these non-traditional mortgage features were merely a symptom of the underlying disease. Second, the focus on payment shock has fostered the sense that the crisis stemmed from mortgage payments becoming so high that borrowers could no longer afford them. While monthly payments obviously cannot exceed the borrower's monthly income, affordability — as commonly understood — was not the cause of the crisis. The real problem was the reversal in housing prices, which stagnated in 2006 and then fell by as much as 60% over the next three years. Homes were suddenly worth far less than the mortgage debt issued against them. The impact of house-price trends soon became clear when subprime fixed-rate mortgages defaulted at roughly the same rate as subprime adjustable-rate mortgages.

It is perfectly easy to show why unaffordable payments should not by themselves cause mortgage defaults. A household with equity in its home — a house worth more than the mortgage — does not default when job loss, divorce, or payment shock causes its income to fall below the level required to meet its monthly mortgage payment. Instead, the home is sold to convert its equity into cash to pay off the unpaid principal. Since the mortgage lender is the first in line to get paid in the event of the home's sale, the home's equity creates a buffer that ensures the lender suffers no loss. A mortgage default occurs only in situations where the unpaid principal balance on a mortgage exceeds the market value of the home. A systemic mortgage crisis like the one in 2007-2008 can therefore occur only when the level of house prices overall falls dramatically relative to the amount of mortgage debt outstanding, causing the value of many homes to fall below their corresponding mortgage balances, and therefore causing many borrowers to default at once.

Mortgage-credit risk is therefore inextricably tied to house-price dynamics. When house prices are expected to rise continuously, the income and payment history of borrowers are of secondary importance when lenders determine credit worthiness. Expectations of continuous increases in house prices also bias household financial decisions, causing household portfolios to be overexposed to housing-market risk. Years of rising prices improve the performance of otherwise questionable mortgages, which encourages progressively looser lending terms and speculation by buyers. Speculative purchases push prices up further, which confirms the expectations of eternal increases in value and generates more positive feedback. This cycle ends only when house prices stop rising, which causes lenders and borrowers to revise expectations of future price changes downward, leading to a contraction in credit and a reduction in demand.

The problem that came to a head in 2007 and 2008, in other words, was that too many people — lenders as well as borrowers — expected house values to continue rising forever and acted accordingly. When those values stopped rising — even before they actually began to fall — the speculative bubble became untenable and a crisis became increasingly likely. All of this had next to nothing to do with the qualifications of homebuyers or the particular terms of mortgage financing. It had to do with an explosion in home prices that eventually proved to be unsustainable, and unmoored from real values.

HOW MUCH SHOULD A HOUSE COST?

If the true cause of the housing crisis was an unsustainable explosion in home prices, the next question we must ask is clear: How do we determine how much a home should cost? Like an automobile or a dishwasher, a house is a durable good; it is valuable because it generates a flow of services over a long period of time. The fundamental value of a house, then, is the value of the shelter services it provides over its useful life. The value of these shelter services can be evaluated monetarily with a measure called the "owners' equivalent rent," which is the rental income an owner could obtain if he moved out of the house and rented it to a third party at current market rates.

As we have seen, mortgage default rates are not a function of a disjunction between the monthly income of a borrower and the monthly mortgage obligations he incurs. Rather, what matters is the disjunction between the price of a home and the income it generates. And that income is best measured in terms of rental value. Unless a household possesses sufficient liquidity to buy a home outright, it is a renter. The question is whether it rents directly from a landlord in the rental market or whether it rents the capital necessary to buy the home in the mortgage market. Whether it is preferable to rent the capital or the home depends on the expected trajectory of house prices. If house prices rise, it is better to rent the capital (and so buy the home) since a mortgage's principal balance is fixed, which means homeowner equity increases with house prices on a dollar-for-dollar basis. Conversely, if house prices decline, the renter is better off because he avoids the decline in household net worth that occurs when the value of the home falls relative to the fixed principal balance on the mortgage, and so avoids the risk of going "underwater."

During the house-price boom of the last decade, this two-sided nature of housing-market risk was ignored. Many mistook the fortuitous capital gains people made as the values of their homes increased as something inherent to homeownership. Renters were ridiculed for throwing their money away, and homeownership rates rose to record levels. Unfortunately, households were accumulating exposure to housing market risk at precisely the time when a price reversal became most likely. The relationship between home prices and owners' equivalent rents can give us a sense of when the risk of such a reversal is high. When house prices rise faster than equivalent rents over a sustained period, house prices become fragile and susceptible to huge declines.

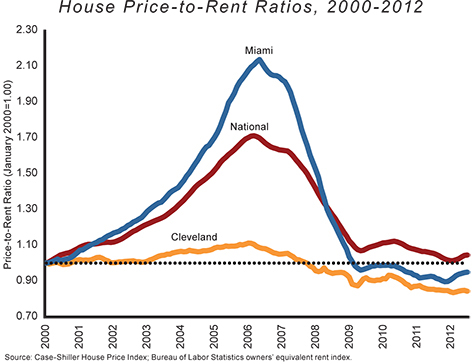

The figure below depicts change (relative to January 2000) in the ratio between house prices and equivalent rents for the Miami and Cleveland metro areas, as well as the entire United States. A level above one for any given date means house prices had risen more than owners' equivalent rents between January 2000 and that date; a level below one means rents had outpaced house prices.

Between 2000 and 2006, the relative price of owning rather than renting in the Miami metro area more than doubled, as house prices increased at an annually compounded average of 19.5%, while equivalent rents increased by just 4.4% per year. Growing at this pace, it would have taken equivalent rents 16 years to reach the 2006 level of house prices. Although soaring house prices caused many to worry about housing "affordability," the annual increase in equivalent rents (4.4%) was actually smaller than the growth in Miami-area per capita income (4.8% per year) over the same period. Housing services were not becoming unaffordable, only buying a house through the mortgage market was.

As the meteoric rise in house prices came to an end, it became clear that recent home buyers had overpaid, as the same housing services could be obtained at less than half the price in the rental market. House prices collapsed, and the price-to-rent ratio returned to parity in less than three years. This boom-bust cycle occurred in much the same way in Tampa, Las Vegas, Phoenix, and parts of California. Between 2006 and 2011, average house prices in these markets declined by between 48% and 62%. For the nation as a whole, the "bubble" was about one-fifth smaller than it was in these so-called "sand states," as some areas of the country — like Cleveland, along with much of the South and Midwest — experienced almost no housing bubble at all.

The bubble itself, rather than the growth in the volume of high-risk mortgages, was the cause of the crash. And in fact, the bubble was also the cause of the explosion of risky borrowing.

MORTGAGE RISK

To avoid "throwing their money away" on rent as house values were skyrocketing, many people who would have been much better off in the rental market instead took out non-traditional mortgages, and it was these mortgages that accounted for almost the entirety of Fannie and Freddie's losses. But these loans — known colloquially as "affordability products" — did not default at high rates because the loans were extraordinarily risky. They defaulted because they were concentrated in geographic regions that saw high rates of mortgage default in general — areas where the house-price bubble was most inflated.

It is important to distinguish these non-traditional mortgages from subprime loans and the subprime market's development. "Subprime" has no formal definition, but it generally refers to loans made to borrowers with poor credit histories. The most widely used instrument for measuring a borrower's credit is a FICO score, which is calculated using an algorithm formulated by the Fair Isaac Corporation. Payment history accounts for about 35% of the FICO score; consumer indebtedness, about 30%; length of credit history, 15%; and types of credit used and acquisition of new credit each account for about 10%. In the current academic literature, a FICO score below 660 is generally considered subprime. Before the FICO algorithm was broadly used, economists referred to a loan as subprime if it was not funded by the GSEs, and if its interest rate exceeded the average rate charged by GSEs by more than 1%. Subprime loans also generally involve very low down payments, which can be risky; a down payment of less than 10%, for instance, will result in a loan-to-value ratio greater than 90%. Under those circumstances, if the house price falls by just 10%, the mortgage will be underwater.

Beginning in 2000, there was a sizeable increase in subprime mortgage loans made to borrowers with weak credit histories, and, according to research by Atif Mian and Amir Sufi, this increase in credit availability likely accelerated house-price inflation to some degree. When attributing blame for the housing crisis, however, it is important to note that the rise of subprime loans occurred simultaneously with the decline of Fannie and Freddie's dominance of the American residential-mortgage markets.

Prior to 1998, only about 8% of the total stock of outstanding residential mortgages was funded by private mortgage-backed securities. Fannie and Freddie's funding advantage from government sponsorship largely crowded out private issuers from the prime segment of the market. Private securities funded "jumbo" loans with principal balances above the GSEs' limits. Between 2000 and 2007, however, private mortgage-backed securities were increasingly used to fund mortgages made to borrowers who had credit scores below the GSEs' minimum threshold (subprime); could not or would not provide full documentation of assets, income, or employment status (Alternative-A or Alt-A); or wanted some other non-traditional feature such as a non-traditional amortization schedule (interest-only or negative amortization). Fannie and Freddie's share of new mortgages issued fell from 70% of the market in 2003 to just 40% in 2006. By 2007, private mortgage-backed securities funded 27% of all outstanding residential mortgages, more than three times the market share they held in 1998.

Fannie and Freddie never purchased subprime loans in any significant quantities. They did build large portfolios of AAA-rated, privately-issued subprime mortgage-backed securities, but these securities differed from whole loans because they generally enjoyed a very substantial credit enhancement — meaning they were structured in a way that made them significantly safer investments. But although they generally stayed away from buying subprime loans directly, the two GSEs did begin acquiring Alt-A and interest-only loans on a large scale at the end of 2005 in an effort to win back market share. While both types of loans had features that made them riskier than traditional, prime mortgages, they were not subprime. Moreover, both types of loans tended to be made to borrowers with relatively high credit scores, and they tended not to involve very low down payments.

About 80% of Fannie and Freddie's combined $213 billion in credit losses between 2008 and 2011 involved mortgages that were either Alt-A, interest-only, or both. As a result, it is common for GSE losses to be attributed to "subprime or other 'high risk' mortgages." Given this performance record, it may seem reasonable to lump these loans with subprime mortgages. Grouping all these non-traditional mortgages into a "high risk" bucket because of high realized-default rates, however, introduces an element of hindsight that thoroughly confuses the issue. It ascribes huge significance to factors like mortgage structure that in reality had very little effect on the volume of mortgage defaults. The simple fact is that any mortgage on a house that declines in price by 70% is likely to appear "high risk" in hindsight.

Alt-A and interest-only loans were called "affordability products" because they were originated in areas — Miami, Tampa, Arizona, Las Vegas, and parts of California — where house prices had grown faster than borrowers' incomes. As a result, these mortgages were concentrated in the precise locations where house prices fell most dramatically when the bubble burst.

As of June 30, 2010, 19% of Fannie Mae's interest-only loans and 15% of their Alt-A loans were seriously delinquent, compared to a 5% default rate for the company's book of business as a whole. The real problem, however, was underwater mortgages; 49% of interest-only loans and 34% of Alt-A mortgages were underwater, compared to just 14% of all loans. This significantly larger share of underwater loans was clearly attributable to declines in home prices: Only 7% of interest-only morgages and 5% of Alt-A loans had original loan-to-value ratios greater than 90%, compared to 9% of all GSE mortgages. Given the proportions of all mortgages underwater, Alt-A and interest-only loans defaulted only about 1.2 times more often than traditional 30-year loans would be expected to default under the same circumstances. The problem wasn't the mortgage types, in other words, but the markets in which the houses in question were purchased.

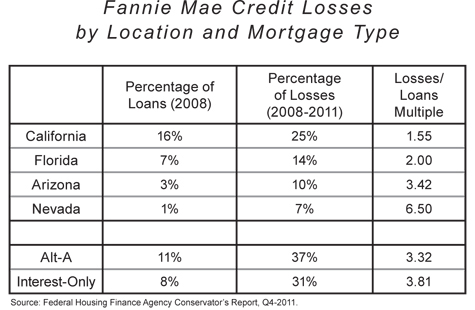

The table above summarizes Fannie Mae's loss experience by location and mortgage type. The first column reports each state or loan type's share of all mortgages outstanding as of December 31, 2008. The second column represents each category's share of all of Fannie Mae's credit losses between 2008 and 2011. The third column reports each category's share of losses as a multiple of its share of all outstanding loans. For example, at the end of 2008, loans outstanding in California accounted for 16% of all loans in America, but the state produced 25% of all credit losses; this means that loans in California generated losses at 1.55 times the average rate. Based on this "loss multiple," the riskiest category of mortgages was not Alt-A (with 3.32 times the average loss rate), or interest-only loans (with 3.81 times the average loss rate), but all mortgages in the state of Nevada, which generated losses at 6.5 times the average rate.

What made an interest-only loan originated in Nevada "high risk," therefore, was not its amortization schedule but the fact that it was originated in Nevada. Even with a traditional 30-year fixed-rate loan, only 3% of the principal balance is paid off in the first three years, so the amortization schedule was practically irrelevant for a 2007 mortgage that defaulted in 2010.

THE HOUSE-PRICE FEEDBACK LOOP

Affordability products like subprime, Alt-A, and interest-only loans were designed to allow borrowers to qualify for credit in markets where prices no longer reflected incomes and equivalent rents. But the existence of these products raises a more interesting question: Why did borrowers seek out mortgages to dramatically overpay for housing? Put another way, why was the for-sale market still so attractive, even as "owning" became so unaffordable?

The answers to these questions likely relate to a special feature of mortgage contracts that allows households to borrow more money against the additional equity their homes gain as house prices rise. Much is made among economists of housing "wealth effects," which capture the subtle impact of rising house prices on the way households make consumption decisions. But rising house prices boost spending more directly by providing households with additional collateral. As home prices rise, households can borrow against the new equity in their homes through mortgage refinancing, home-equity loans, and home-equity lines of credit. The interest rate on a mortgage — including transaction costs paid out over the life of the loan — is well below the interest rate on unsecured borrowing (such as credit cards).

The ability to pledge a home as collateral for consumer loans, therefore, can substantially increase the consumption opportunities for a homeowner relative to a renter with the same income. At its peak in 2005 and 2006, home-equity withdrawal averaged more than $200 billion per quarter — the equivalent of 12% of U.S. personal-consumption expenditures. This likely reinforced the idea that owning a home is the surest path to wealth creation for the majority of Americans, which caused more households to buy rather than rent, and in turn increased house prices even further and led to even more home-equity extraction.

The use of affordability products was not limited to new buyers: About one-third of the Alt-A loans originated between 2005 and 2008 were for refinancing homes for additional cash. Research by Michael LaCour-Little, Eric Rosenblatt, and Vincent Yao into foreclosures in Southern California between 2006 and 2008 found that in virtually every case of foreclosure, the borrower had used large amounts of the property's equity to take out additional loans through refinancing or home-equity lines.

For example, as a $300,000 house increased in value to $550,000 — the average appreciation in Los Angeles between 2003 and 2006 — the typical borrower in the sample responded by assuming $200,000 of additional debt, mostly to fund consumption expenditures. When the price of the house later dropped to $345,000 — the average decline in Los Angeles between 2006 and 2008 — the new mortgage balance was 32% greater than the market value of the house, even though the house had actually appreciated by 15% since 2003. Even after the resulting foreclosure, borrowers came out ahead in the end. In the sample, households took out $2.74 for every $1 of initial equity, and the amount of equity withdrawn was twice as large as the ultimate losses incurred by lenders (including Fannie Mae and Freddie Mac).

Many who already owned a primary residence also took advantage of the upward trajectory of home prices in the mid-2000s. The National Association of Realtors estimates that homes purchased for vacation or investment purposes ranged between 33% and 40% of all home sales between 2005 and 2007. And many of those purchases were financed through non-traditional mortgage options. Between one-fifth and one-third of Alt-A and negative amortizing loans (another high-risk loan product that actually allows the principle to increase) were used to buy second residences or investment properties — a rate between two and three times greater than the average for all mortgages.

Of course, all these data assume that borrowers accurately identified the intended purpose of their loans, which is unlikely to be the case. Evidence suggests widespread fraud, with many people taking out these mortgages to buy investment properties or second homes while classifying their purchases as primary residences to secure lower interest rates. Alternative mortgage structures with negative amortization schedules or low teaser rates thus provided "house flippers" with a way to make leveraged bets on continued house-price inflation at a lower cost than traditional 30-year loans. This increased demand in the housing market, helping to drive the astronomical increase in home prices.

THE FAILURE OF FANNIE AND FREDDIE

While Fannie Mae and Freddie Mac are often blamed for the mortgage crisis, the causes of their failure have been widely misunderstood. Many observers who focus on the types and terms of mortgages as sources of the GSEs' collapse have suggested that affordable-housing requirements contributed to the problem. Congress and the Department of Housing and Urban Development in recent decades have imposed (and have repeatedly intensified) rules requiring the GSEs to provide affordable-housing loans to lower-income borrowers, and these observers say this contributed to the excessive risk the two companies took on.

But this assumption, too, turns out to be largely unfounded. The Alt-A and interest-only loans that helped topple the GSEs were not especially useful in reaching those income-based affordable-housing goals. The percentage of Fannie Mae's Alt-A loans that counted toward affordable-housing goals fell short of HUD's overall requirements every year between 2001 and 2008, according to data from the Financial Crisis Inquiry Commission. Because too many of the Alt-A loans could not be applied toward the overall HUD requirements, increases in Alt-A lending had to be offset by a larger number of traditional mortgages that did count toward the income-based housing goals.

In fact, it was the same factor that caused borrowers to choose Alt-A loans — the lack of income documentation — that also made these loans ineligible to be counted toward the income-based affordable-housing requirements. As John Weicher, Assistant Secretary for Housing at HUD and Federal Housing Commissioner under President George W. Bush, pointed out in 2010, if the marginal purchase of an Alt-A mortgage made the attainment of income-based housing goals less likely, one can safely conclude that the increase in the GSEs' Alt-A mortgage purchases after 2005 were motivated by business considerations (and shareholder profits) rather than by affordable-housing mandates.

Another common complaint — that the role played by the GSEs as a peculiar sort of public-private hedge fund contributed to their collapse — also appears to be poorly founded. Fannie and Freddie have a complicated, two-sided business model. One side is the well-known securitization business through which the enterprises fund home loans by issuing mortgage-backed securities to investors. The other is a capital-market business in which GSEs issue debt to buy securities — often funding the purchase of the same mortgage-backed securities they issued.

Before the housing crisis, the latter aspect — the hedge-fund aspect of the business — was the focus of concern for many would-be reformers, including former Federal Reserve chairman Alan Greenspan. They worried that the GSEs' large, debt-funded portfolios of mortgage securities created systemic risk. Greenspan argued that the portfolios made the GSEs vulnerable to large shifts in interest rates that could cause the market value of their liabilities to greatly exceed the market value of their assets; this would cause the enterprises to flounder, precipitating a taxpayer bailout. To reduce this risk, Greenspan advocated a hard cap on GSE portfolios, which would focus their operations away from their hedge-fund investment activities and toward their traditional guarantee business. The Bush Administration embraced this reform, as did the Senate Banking Committee which passed legislation to this effect in 2005, though the bill never became law.

As it turned out, however, the traditional guarantee business, not the hedge-fund operation, was the undoing of the GSEs. Between January 2008 and June 2012, the GSEs lost a combined total of $216 billion, net of dividends. Of that total, $213 billion came from losses on their single-family mortgage guarantees, while the remainder came from accounting changes. Mortgages originated in 2006 and 2007 accounted for between 63% and 66% of total credit losses. The investment portfolios actually generated a cumulative net profit of $13 billion over the same period. Thus, while GSEs were indeed vulnerable, reformers had been focused on the wrong side of the business, and their proposed reforms would not have averted the eventual taxpayer bailout.

Those who advocated reform before the crisis were right to worry, however, about implied federal support for ostensibly private, shareholder-owned corporations. Such an assumption creates conditions ripe for exploitation, as risk is transferred from creditors to taxpayers and any reward is kept by shareholders and management. The assumption of a federal backstop was the most damaging flaw in the financial regulatory system in the years leading up to the financial crisis. Fannie and Freddie were not regulated by financial-market participants, who believed their obligations to be backed by the Treasury, nor were they regulated by government officials, who were hamstrung by their limited authority over the enterprises.

Yet the GSEs were not the only financial institutions to collapse in 2008, and it would seem the most salient lesson of the crisis was just how far and wide the implied government safety net extended. While the government had no legal obligation to bail out the GSEs, market participants bet on Fannie and Freddie, assuming that the Treasury would have no choice but to rescue them in a crisis because the costs of failing to do so would have been far greater. The same cost-benefit arithmetic is what motivated the TARP bailout, as well as the rescue of the auto industry.

THE FUTURE OF MORTGAGE FINANCE

Today, policymakers favor two approaches to preventing another mortgage crisis. But both ignore the evidence that has come to light in the last five years about the causes of the crisis, and both neglect the real problems that linger in the American mortgage system.

First, now that the crisis is over, it is easy for policymakers to pledge that this most recent bailout was the last. But promises to end to all public guarantees of mortgage credit mean little when the housing market is relatively stable; during a crisis, adhering to such a pledge requires a tolerance for chaos and for public panic that most elected officials do not have. As a result, mortgage credit will not be guaranteed by the government — except in a crisis, when such guarantees will inevitably be deemed essential for the good of the economy. The promise that we have seen the last bailout, therefore, does little to effect change in housing-finance markets.

Apart from no-bailout pledges, policymakers' other favored solution has been to pass rules that restrict the types of mortgages that GSEs or other public guarantors are allowed to purchase. This approach, however, ignores the evidence discussed above about the true origins of the most recent crisis. Instead, the new regulations take for granted the original, mistaken interpretation of the crisis — that the problem was poor mortgage-contract design and not unsustainable increases in home prices.

The Consumer Financial Protection Bureau (created in 2011 by the Dodd-Frank financial-regulation reform law) recently adopted an "Ability-to-Repay Rule," which will require that, starting in January 2014, in order to receive liability protection, lenders must take steps to verify that borrowers have the ability to repay their loans. To do this, lenders must ensure that mortgages meet "qualified mortgage" loan parameters, which explicitly exclude negative amortization schedules and interest-only loans, as well as loans with terms longer than 30 years. These regulations could make it more costly to speculate on housing, but they will also disadvantage households with adequate but inconsistent incomes that made prudent use of non-traditional amortization schedules to finance home purchases.

Unfortunately, recent regulatory efforts to standardize mortgages have ignored the mortgage-contract feature that seems to have played a much larger role in the crisis: the feature that allows households to take on additional debt through cash-out refinancing or home-equity loans as the value of their homes increase. The new qualified-mortgage rules require a household to pay off a portion of its principal each month, but the rules do not restrict a household's ability to later extract this equity through incremental borrowing. Federal Reserve data suggest that, between 1999 and 2007, households withdrew $5.7 trillion in equity from their homes. This incremental borrowing eliminated the buffer that would have otherwise protected lenders from loss.

More importantly, as described above, the rise in home prices was driven in large part by the ease with which a household could use additional home equity to borrow cash. Households cannot sell off part of a home when it increases in price. Without refinancing and home-equity loan options, households could only liquefy house-price increases by selling the home, moving out, and downsizing to a less expensive residence. The transaction costs involved — realtor fees, closing costs, the disruption and costs associated with moving — would dramatically reduce the allure of housing as an investment. Under these circumstances, the house-price boom would have been far less dramatic and the subsequent crisis significantly less severe.

The CFPB's efforts to standardize mortgages appear to be aimed at encouraging the issuance of private mortgage-backed securities, which has remained moribund since the crisis. The problem is that the type of investor who bought the AAA tranches of private mortgage-backed securities does not want to worry about the mortgages that collateralize their investments. These investors buy AAA debt precisely because it relieves them of the obligation to study the likely credit performance of the pool of loans. But since it was the crash of the housing market — and not the type of mortgages made available in the last decade — that brought about the credit losses, standardizing mortgage types would not relieve these investors of their worries. Policymakers should therefore not assume pools of capital willing to hold government-backed AAA securities would be equally inclined to hold private mortgage obligations.

TARGETING SOLUTIONS

When policymakers attempted a major regulatory reform of the GSEs in 2005, Fannie and Freddie argued that, as long as they were not subject to a long list of new regulations, they would have the flexibility to rescue the American mortgage market in the event of a crisis. Alan Greenspan mocked this suggestion, pointing out that holding mortgage-backed securities does not provide purchasing power to buy mortgage-backed securities. As Greenspan trenchantly recognized at the time, in the event of a genuine mortgage crisis, the GSEs would be the first to fail. Unfortunately, that is exactly what happened in 2008.

Given the scale of the crisis, the GSEs' losses could have been far worse; in fact, their $216 billion in losses between 2008 and 2011 was equal to less than 5% of the GSEs' combined book of business. Had these institutions simply been required to hold equity capital in roughly the same proportion that banks are, shareholders would have absorbed all of the losses, and the taxpayer bailout would have been unnecessary. This is perhaps the simplest and most straightforward of all the lessons of the crisis — and it could be the least complicated and most effective reform to implement — but it seems to be the least appreciated.

As legislators and regulators continue to pursue the right mix of rules for the home-loan industry, it is vital that they correctly identify the problems to be solved. The key to avoiding the next crisis may well be understanding the causes and character of the last one.